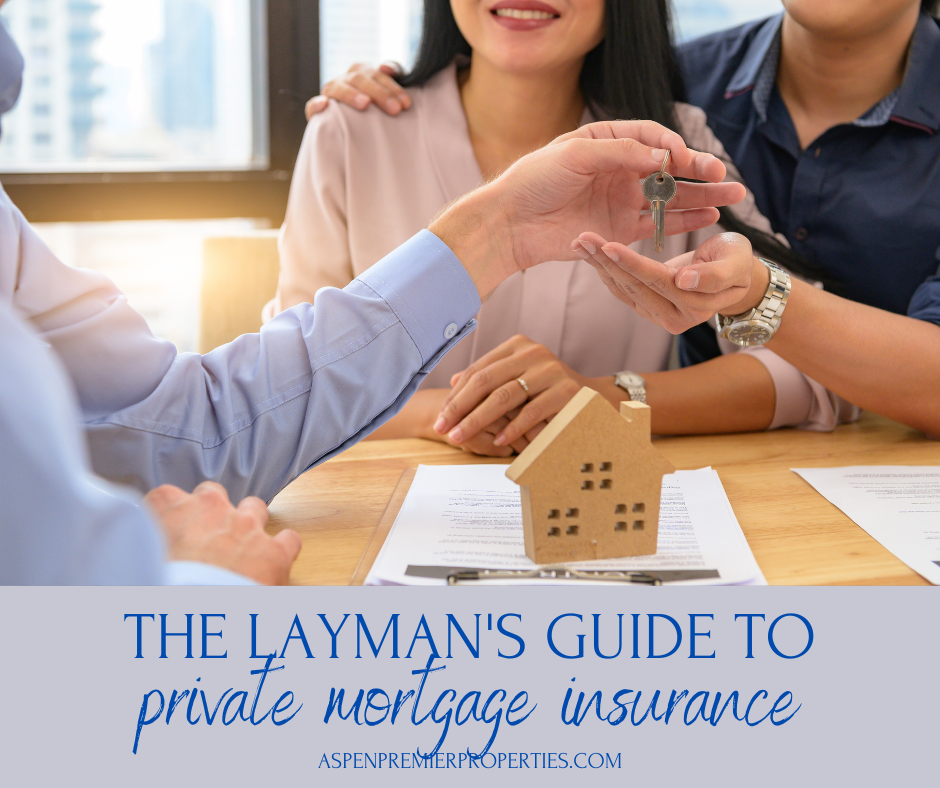

If you’re like many people, you know you have to buy private mortgage insurance, or PMI, when you finance a new home in Aspen. But what is PMI, who has to pay it, and how much does it cost? This guide to private mortgage insurance explains.

The Layman’s Guide to Private Mortgage Insurance

Home financing can be mysterious – there’s a lot of fine print involved. And while many lenders do their best to explain everything, sometimes people just don’t know what to ask. First things first, though: If you have a question about financing, talk to your REALTOR® or lender. They’ll get you pointed in the right direction.

Some of the most common questions people have about private mortgage insurance include:

- What is PMI?

- Is private mortgage insurance bad?

- Who do you pay when you buy PMI?

- How does the insurance work?

- What party does PMI protect?

- Can you avoid paying for PMI?

- How much does PMI cost every year or every month?

- Do you get your PMI back?

- When can you stop paying for private mortgage insurance?

Here’s a closer look at each.

What is PMI?

Private mortgage insurance is a type of insurance that lenders often require borrowers to buy. The insurance protects the lender – not the buyer. It’s a policy that ensures the lender gets some of its money back if the buyer defaults on payments.

Lenders typically only require buyers to purchase PMI when they have a down payment of less than 20 percent. If you’re putting down a 20 percent (or greater) down payment, your lender is unlikely to tell you that you have to buy it.

Is private mortgage insurance bad?

Private mortgage insurance isn’t bad, but it costs you money that would otherwise stay in your pocket. For many people, it’s worth it; for others, it’s not. If you want to buy a home now but you don’t have enough cash stashed away for a 20 percent down payment, you’re most likely going to be required to buy it. If you can wait a while and save up enough money for a 20 percent down payment, you may want to do that to avoid paying for PMI.

Who do you pay when you buy PMI?

Your mortgage insurance company receives your PMI payments. It doesn’t go directly to your lender. In fact, your lender won’t get any of it unless you fail to make your house payments; in that case, the insurance company pays the lender.

How does the insurance work?

When you buy private mortgage insurance, you’ll pay a monthly premium. In many cases, it’s included in your monthly mortgage payment – although it may not be, so you’ll have to make sure to read all your paperwork to avoid missing payments.

If you walk away from your mortgage without paying it in full, your lender will submit a claim to the PMI company. Then, your lender will try to recoup the rest of its money by selling your home.

What party does PMI protect?

Private mortgage insurance only protects your lender. It kicks in if you fail to make your monthly payments.

Can you avoid paying for PMI?

You can avoid paying for PMI by putting down 20 percent or more on the home you’re borrowing against. You may also be able to avoid buying private mortgage insurance if you take out a VA loan or USDA loan.

Related: Can you buy a home in Aspen with a VA loan?

How much does PMI cost every year or every month?

Private mortgage insurance typically costs between 0.5 and 1 percent of your loan’s entire balance on an annual basis. Without getting too sticky in the math department, you can use this guide as a ballpark – but you’ll definitely have to talk to your lender to get an accurate figure for your loan.

| Loan Amount | Annual PMI Range | Monthly PMI Range |

| $100,000 | $500 to $1,000 | $42 to $83 |

| $200,000 | $1,000 to $2,000 | $83 to $167 |

| $300,000 | $1,500 to $3,000 | $125 to $250 |

| $400,000 | $2,000 to $4,000 | $167 to $334 |

| $500,000 | $2,500 to $5,000 | $209 to $416 |

| $600,000 | $3,000 to $6,000 | $250 to $500 |

| $700,000 | $3,500 to $7,000 | $292 to $584 |

| $800,000 | $4,000 to $8,000 | $334 to $667 |

| $900,000 | $4,500 to $9,000 | $375 to $750 |

| $1,000,000 | $5,000 to $10,000 | $416 to $834 |

Do you get your PMI back?

You won’t get the money you spend on PMI back. It’s like any other type of insurance – you pay for it in case you need it, except in this case, you pay for it in case your lender needs it.

When can you stop paying for private mortgage insurance?

Usually you can stop paying for PMI once you’ve built up 20 percent equity in your home. Lenders are required to drop it once you have 22 percent equity, but you can call your lender and ask them to drop it after you hit that magic 20 percent figure.

Are You Selling or Buying a Home in Aspen?

If you’re ready to sell your home in Aspen, Woody Creek, Basalt, Carbondale or Snowmass, we may be able to help you.

Get in touch with us right now to find out how much your home is worth – and discover how we’ll be able to help you sell it quickly and for top dollar.

If you’re also looking for a home for sale in Aspen or a nearby community, check out our listings by price:

- $200k to $300k

- $300k to $400k

- $400k to $500k

- $500k to $600k

- $600k to $700k

- $700k to $800k

- $800k to $900k

- $900k to $1 million

- Over $1 million

$10,995,000

$10,995,000

1227 Mountain View Drive Units 1 & 2 Aspen, Colorado

4 Beds 4 Baths 2,080 SqFt 0.4 Acres